January 1, 2019 marked the start of a new data collection period for laboratories pursuant to the Medicare Clinical Diagnostic Laboratory Tests Payment System Final Rule (“CLFS Rule”).¹ The CLFS Rule establishes the Centers for Medicare & Medicaid Services’s (“CMS’s”) new private payor-based rate-setting system for clinical diagnostic laboratory tests (“CDLTs”) paid under the Medicare Part B Clinical Laboratory Fee Schedule (“CLFS”).

The data collection period is an integral part of CMS’s new rate-setting mechanism for CDLTs. After nearly three decades without reform, Section 216 of the Protecting Access to Medicare Act of 2014 (“PAMA”)² requires CMS to replace its previous outpatient lab services payment rates, which were based on historical lab charges adjusted for inflation, with new rates based on current charges in the private health care market. CMS estimates that the new payment system will save Medicare $3.9 billion over 10 years.

Pursuant to the CLFS Rule, any laboratory qualifying as an “applicable laboratory” is required to collect and report applicable information regarding its private market payments for CDLTs to CMS, including the following:

- The Healthcare Common Procedure Code System (“HCPCS”) code for the test;

- Each private payor rate for the test described by its respective HCPCS code for which final payment has been made; and

- The associated volume of tests performed corresponding to each private payor rate.

In its final rule regarding the CY 2019 Medicare Physician Fee Schedule (“Final Rule”),³ CMS further clarified what it means to be an applicable laboratory. Effective January 1, 2019, the Final Rule provides that an entity will satisfy the definition of “applicable laboratory” if it meets the following criteria:

- The entity is a laboratory as defined under the Clinical Laboratory Improvement Amendments at 42 C.F.R. § 493.2.

- The laboratory bills Medicare under its own National Provider Identifier, or for hospital outreach laboratories, bills Medicare Part B on the Form CMS-1450 under TOB 14x (non-patient).

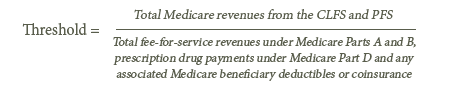

- The laboratory receives more than 50 percent of its total Medicare revenues from one of, or a combination of, the CLFS or the Physician Fee Schedule during a data collection period meeting the “majority of Medicare revenues” threshold. Pursuant to the Final Rule, total Medicare revenues no longer includes Medicare Advantage payments under Medicare Part C. The following formula should be utilized by laboratories when determining whether it meets the “majority of Medicare revenues” threshold:

- The laboratory receives at least $12,500 of its Medicare revenues from the CLFS during a data collection period, meeting the “low expenditure” threshold.

Reporting entities4 are required to collect applicable information during the current data collection period, running from January 1, 2019 until June 30, 2019. Laboratories and other reporting entities will then have until December 31, 2019 to determine whether they meet the aforementioned Medicare revenues thresholds based on the data collected and, for those meeting the definition of applicable laboratory, validate the applicable information to be reported to CMS. After the time for validation ends, all applicable laboratories will be required to report their applicable information to CMS. This data reporting period will begin on January 1, 2020 and end on March 31, 2020.

CMS is hosting a call on Tuesday, January 22, 2019, from 2 to 3 PM ET regarding the Clinical Diagnostic Test Payment System, during which participants will be able to ask questions about the upcoming data collection and reporting periods. Laboratories and other interested parties can register for the call and download presentation materials via CMS’s website, which can be found here.

If you have questions or would like additional information about this topic, please contact:

- Amy Poe at (919) 228-2404 or apoe@wp.hallrender.com;

- Kerry Dutra at (919) 228-2405 or kdutra@wp.hallrender.com;

- Regan Tankersley at (317) 977-1445 or rtankersley@wp.hallrender.com; or

- Your regular Hall Render attorney.

¹42 C.F.R. §§ 414.500 et. seq.

²42 U.S.C. § 1395m-1.

³Medicare Program: Revisions to Payment Policies Under the Physician Fee Schedule and Other Revisions to Part B for CY 2019, 83 Fed. Reg. 226 (November 23, 2018).

4 Applicable information is collected from and reported by “reporting entities,” which are the entities at the Taxpayer Identification Number (TIN) level, for their components that are applicable laboratories.