Background

The Hart-Scott-Rodino Antitrust Improvements Act of 1976 (“HSR”), as amended, requires all persons contemplating certain mergers or acquisitions that meet or exceed the jurisdictional thresholds (shown below) to file notification with the Federal Trade Commission (“FTC”) and Department of Justice (“DOJ”) Antitrust Division and to wait a period of time before consummating the transaction.Each fiscal year, the jurisdictional filing thresholds are adjusted to reflect the percentage change in the gross national product. The FTC announced the new jurisdictional filing thresholds on January 21, 2016. These changes will become effective 30 days after being published in the Federal Register.

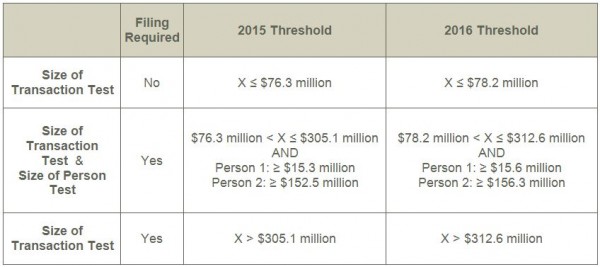

Filing Thresholds

Parties must analyze their transactions against the “Size of Transaction” and “Size of Person” reporting thresholds. The “Size of Transaction” test is concerned with the value (through voting securities, NCI, assets or a combination thereof being transferred) of what is being acquired whereas the “Size of Person” test generally measures a company based on its last regularly prepared annual statement of income and expenses and its last regularly prepared balance sheet. To determine whether an HSR filing is needed, parties should analyze the transaction utilizing the following steps.

- Will an acquiring person hold an aggregate amount of voting securities and assets less than $78.2 million? If yes, then no HSR filing is needed. If no, move to Step 2.

- Will an acquiring person hold in excess of $78.2 million but not in excess of $312.6 million? If yes, then move to Step 3. If no, then move to Step 4.

- Does one person to the transaction have sales or assets of at least $15.6 million? If yes, then an HSR filing is needed. If no, then no HSR filing is needed.

- Will an acquiring person hold in excess of $312.6 million? If yes, an HSR filing is needed.

For purposes of this analysis, the value of any assets under consideration is the fair market value of the entity’s non-cash assets without regard to whether those assets are subject to a mortgage or how the assets might have depreciated for accounting purposes. The table below summarizes the 2016 reporting thresholds under the HSR Act.

Filing Fee

In connection with an HSR filing, the acquiring person must pay a filing fee at the time of filing by electronic wire transfer. The amount of the filing fee depends upon the size of the transaction as follows.

Penalty

Any person (or officer, director or partner) who fails to notify the FTC and DOJ of a reportable transaction faces a civil penalty of $16,000 for each day on noncompliance.If you have any questions or would like additional information about this topic, please contact one of the following members of Hall Render’s Antitrust Practice Group:

- William E. Berlin at (202) 370-9582 or wberlin@wp.hallrender.com;

- Clifton E. Johnson at (317) 977-1430 or cjohnson@wp.hallrender.com;

- Michael R. Greer at (317) 977-1493 or mgreer@wp.hallrender.com;

- John F. Bowen at (317) 429-3629 or jbowen@wp.hallrender.com; or

- Your regular Hall Render attorney.

Please visit the Hall Render Blog at http://blogs.hallrender.com/ or click here to sign up to receive Hall Render alerts on topics related to health care law.